georgia ad valorem tax motorcycle

Fee 1 to the County Tag Agent 69 to State of Georgia General Treasury Annual Renewal. Jan 14 2015 1.

2012 Black Cross Country.

. My 07 FLHTC GA tag was 166 this year. Jul 26 2012 Messages. The basis for ad valorem taxation is the fair market value of the property which is established January 1st of each year.

Ad Valorem is latin for according to value. Breeze3at May 30 2012 4 glimmerman Active Member. Anybody registered a 2012 or 2013 victory in Georgia brought in from another.

Motorcycles may be subject to the following fees for registration and renewals. This includes an annual registration and tag fee of twenty dollars an ad Valorem tax sales tax and a title fee of eighteen dollars. Wednesday March 9 2022.

Of the Initial 90 fees collected for the issuance of these tags the fees shall be distributed as follows. TAVT rates are set by the Georgia Department of Revenue. Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current market value of your motorcycle.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. You will need to pay the following fees when applying for motorcycle registration and title. Of the Initial 80 fees collected for the issuance of these tags the fees shall be distributed as follows.

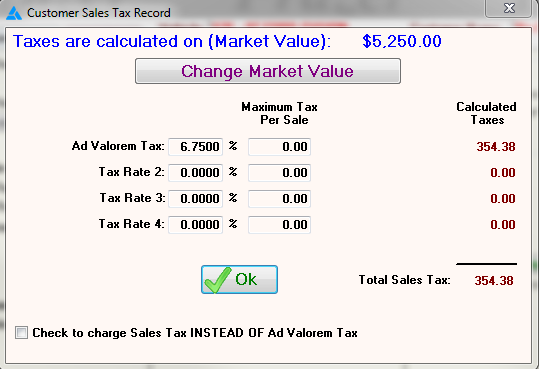

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The tax is levied on the assessed value of the property which by law is established at 40 of the fair market value. We would like to show you a description here but the site wont allow us.

20 Annual License Reg. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle.

Proof of Georgia motorcycle insurance. It varies county to county. Cost to renew annually.

Your Georgia drivers license or ID. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes.

2000 annual registration fee. Registration Fees Taxes. 5500 plus applicable ad valorem tax.

This tax is based on the value of the vehicle. 90 plus applicable ad valorem tax. Fee 1 to the County Tag Agent 59 to State of Georgia General Treasury Annual Renewal.

A Rolls Royce pays a lot more for tags than a Chevy. Submit the above either in person or by mail to your local county tag office. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA.

PdfFiller allows users to edit sign fill and share all type of documents online. 393 Type of Motorcycle Currently Riding. Georgia ad valorem tax motorcycle.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Cost to renew annually. 5500 plus applicable ad valorem tax.

I thought GA was bad until I read what SC is. Take your completed forms and payment for the 12 license plate fee plus any payment for any required ad valorem tax to the GA Tax Commissioners tag office in your county. Once the GA tag office has processed your application they will issue you a serial plate or T serial plate which you must affix to your trailer.

Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015. Vehicles subject to TAVT are exempt from sales tax. Payment for the 20 registration fee plus any other applicable taxes and fees.

Title Ad Valorem Tax TAVT The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. 20 Annual License Reg. I have kept my Dyna registered in FL where tags are a set rate each year about 35.

The Annual Ad Valorem Tax is imposed on vehicles that have not been taxed under the Title Ad Valorem Tax in Georgia. 2021 Property Tax Bills Sent Out Cobb County Georgia. 80 plus applicable ad valorem tax.

Ad valorem tax more commonly known as property tax is a large source of revenue for governments in Georgia. Ad Register and Subscribe now to work with legal documents online.

Tavt Information Georgia Automobile Dealers Association

Tax Rates Gordon County Government

It Doesn T Matter Whether You Are Investing On Real Estate Or Shares As Long As Our Small Business Consulting Business Consultant Services Accounting Services

Georgia Used Car Sales Tax Fees

Frazer Software For The Used Car Dealer State Specific Information Georgia

What Are Ad Valorem Taxes Henry County Tax Collector Ga

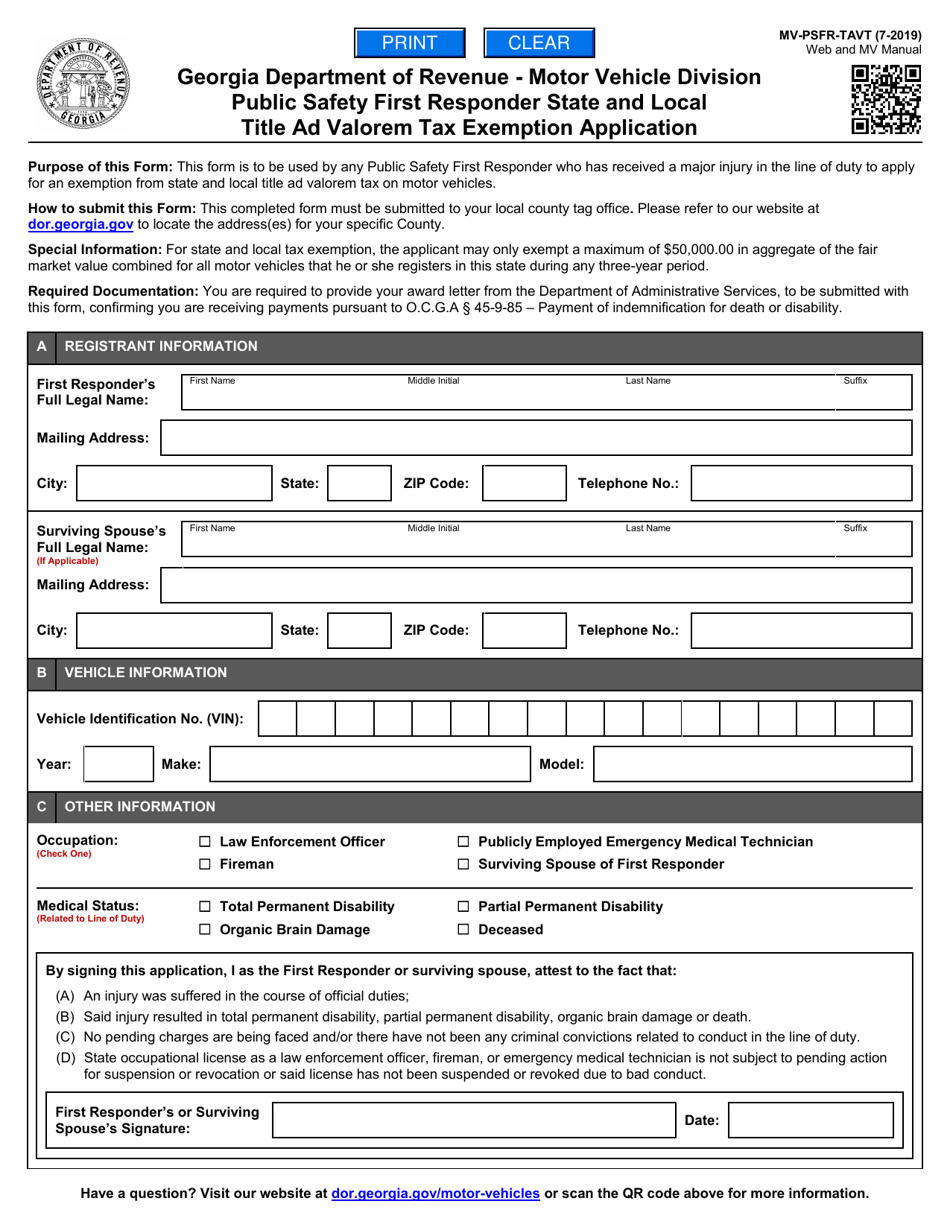

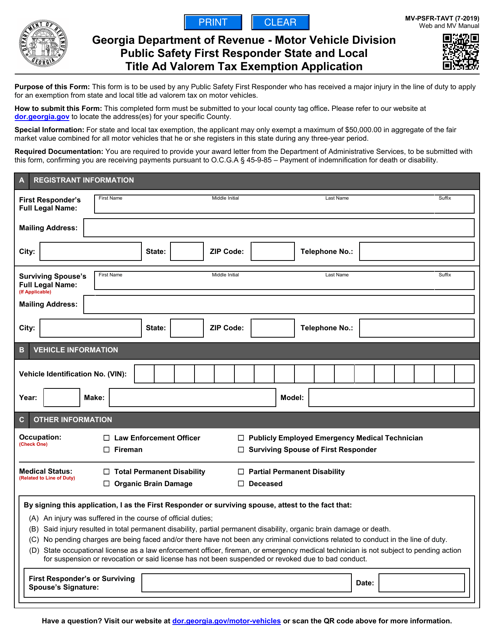

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

Vehicle Taxes Dekalb Tax Commissioner

Georgia Motor Vehicle Ad Valorem Assessment Manual

New Georgia Lease Laws Milton Martin Toyota Gainesville Dealership

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier

Business Personal Property Tax Return Augusta Georgia Property Tax Personal Property Tax Return